22+ mortgage rate lock in

Lock Your Rate Now With Quicken Loans. When a homebuyer locks in a mortgage rate that means they have agreed.

Unreal Engine 5 0 Release Notes Unreal Engine 5 0 Documentation

Trusted VA Home Loan Lender of 300000 Military Homebuyers.

. Ad Were Americas 1 Online Lender. Web Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. Web If you dont lock in your interest rate rising interest rates could force you to make a higher down payment or pay points on your closing agreement.

Interest rates may fall after you lock in. Low Fixed Mortgage Refinance Rates Updated Daily. Web This ensures you will have that rate when you get to your closing.

Traditional locks can be a gamble. Web 1 day agoToday UrbanTurf offers a brief explanation of what it means to lock in an interest rate. Ad Compare Best Mortgage Refi For 2023.

Contact a Loan Specialist. The Best Lenders All In 1 Place. Consider if you lock in a 674 percent rate on a 30-year loan for.

Mortgage Rates Reverse Course From Last Week S All Time Low Housingwire Single-family. Web Given how quickly current mortgage rates have climbed this year locking in your rate can pay off. Some downsides to locking in your rate right away include the following.

VA Loan Expertise and Personal Service. Web A 15-year fixed-rate mortgage with todays interest rate of 617 will cost 853 per month in principal and interest on a 100000 mortgage not including taxes. Web Cons Of Locking Your Mortgage Rate Today.

A mortgage rate lock also referred to as rate protection is a guarantee from your home loan lender. Web Often the buyer can lock in the rate any time after they are approved and sign the purchase agreement up to five to 10 days before closing. Web A lock-in or rate lock on a mortgage loan means that your interest rate wont change between the offer and closing as long as you close within the specified time.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Get Your Quote Today. Apply Online Get Pre-Approved Today.

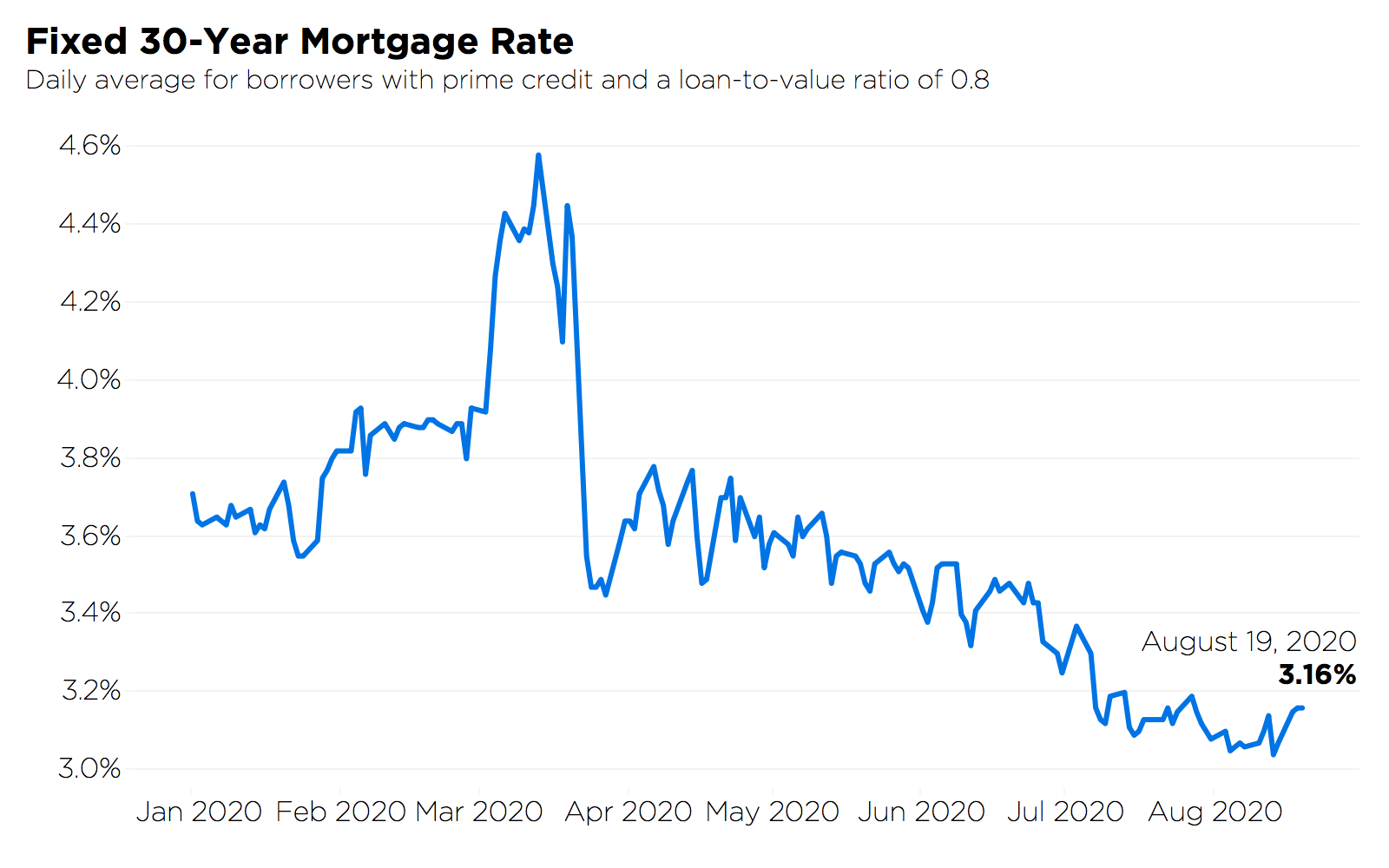

Lock Rates For 90 Days While You Research. The Feds actions contributed to a steady decline in mortgage rates where the average 30-year mortgage rate hit a low of 265. Web A traditional mortgage rate lock will secure an interest rate during the application process.

Protect Yourself From a Rise in Rates. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web For example a borrower who chooses a 30-day lock on a fixed-rate 30-year loan might pay a 4 percent rate and zero points while a 60-day lock might cost 1 point.

Dont Settle Save By Choosing The Lowest Rate. It ensures that your. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best.

Typically rate locks are only offered once you have a fully ratified sales contract. Locking in early can help you get what you were budgeting for. When you pay an.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Get Instantly Matched With Your Ideal Mortgage Loan Lender. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web What Is a Mortgage Rate Lock. This process takes 30- 90 days.

Web If your rate lock will expire prior to closing and disbursement of funds a rate lock extension will be required to close your loan. Ad Compare Best Mortgage Lenders 2023. You may be able to.

Web Two months later it was 005. Lock Your Rate Now With Quicken Loans. Save Time Money.

Protect Yourself From a Rise in Rates. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Web 12 hours agoTodays average rate on a 30-year fixed mortgage is 692 up 020 from the previous week.

We will extend your rate lock at no cost to you. Ad Were Americas 1 Online Lender. Web At the start of this week the average rate for a 30-year fixed-rate mortgage FRM for a highly qualified borrower was 654 according to Mortgage News Dailys.

No SNN Needed to Check Rates. If you lock in todays rate of 676 on a 30-year fixed-rate jumbo. Web A mortgage rate lock is an agreement between you and your lender to temporarily lock your interest rate for a specific period of time typically 30 to 90 days.

Web Locking in a mortgage rate protects you against rate hikes that lead to higher monthly payments and long-term costs especially during times of volatility. Web You can choose to lock in your mortgage rate from the moment you select a mortgage up to five days before closing. Web For example the monthly payment on a 300000 loan at a 30-year fixed rate would go up by 88 if the interest rate increased from 4 to 45.

Case All Galaxy Devices Quad Lock Usa Official Store

When Should You Lock Your Mortgage Rate Money

Why It S Super Important To Lock Your Mortgage Rate

Mortgage Rates Are At Record Lows Here S What That Means For You Zillow Group

Mortgage Rates Are Going Up In 2022 Lock Your Mortgage Rate In Now While You Shop Urgent Youtube

Free Download Indie Kid Wallpaper Hippie Wallpaper Edgy Wallpaper Retro For Desktop Mobile Tablet 676x120 Hippi Oboi Hipsterskie Komnaty Vintazhnye Plakaty

As Mortgage Rates Climb One Big Thing Homebuyers Should Consider Doing Now Marketwatch

When Should I Lock In My Mortgage Rate New American Funding

1 Conventional Fha Va Usda Purchase Loan Guide Top Rated Local Buildbuyrefi Home Loan Experts 1 Construction Renovation Cash Out Purchase Loan Experts Buildbuyrefi Com

Should I Lock In A Mortgage Rate Today What To Consider As Rates Fluctuate Bloomberg

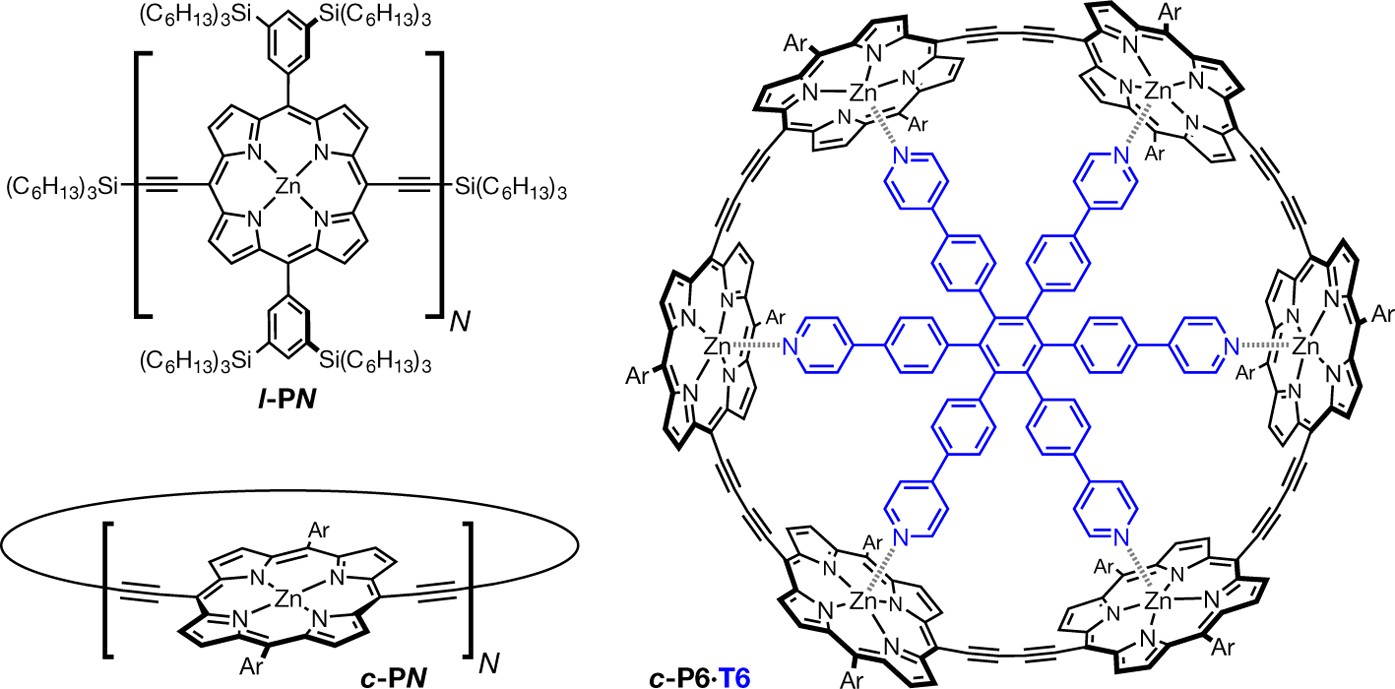

Aromatic And Antiaromatic Ring Currents In A Molecular Nanoring Nature

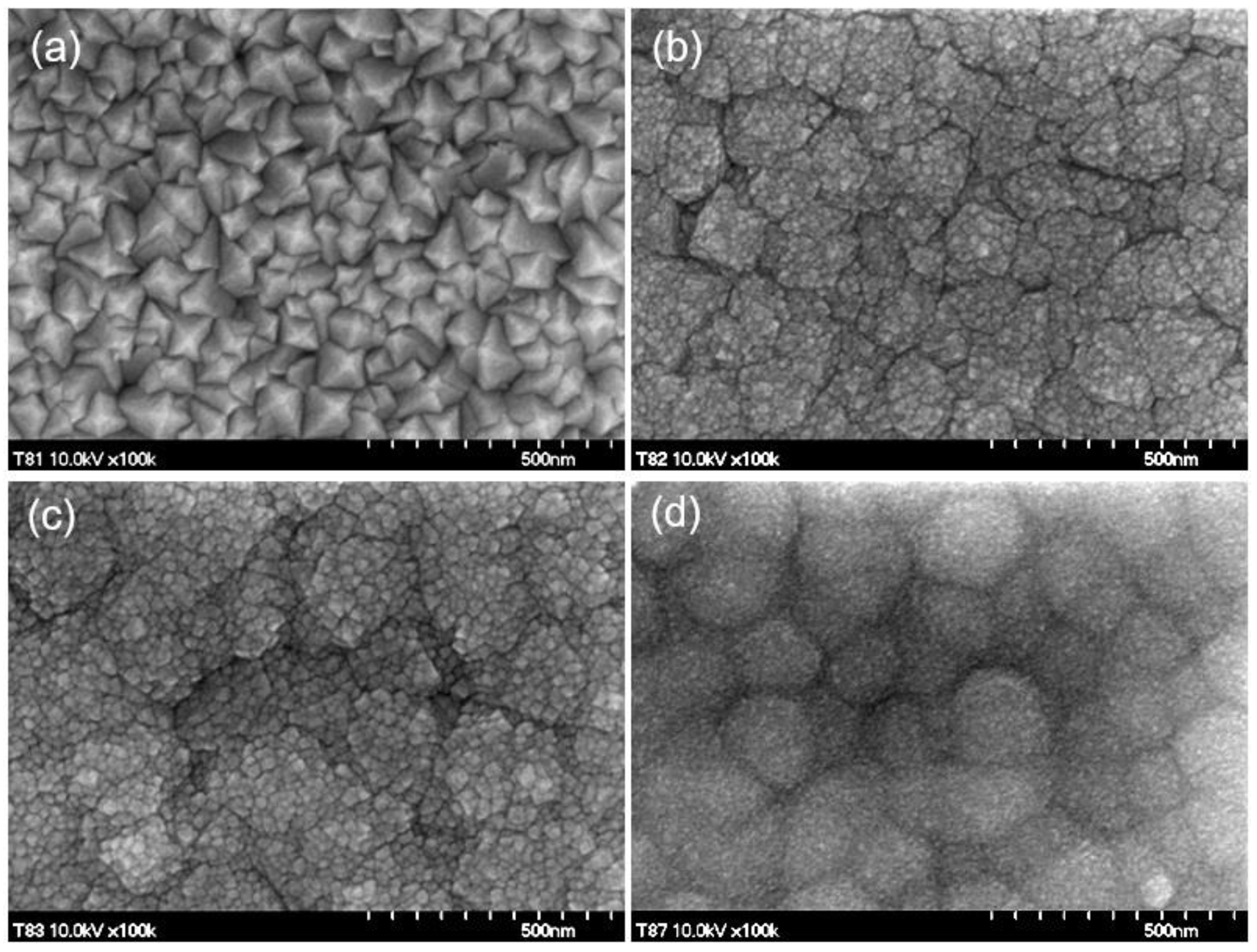

Nanomaterials Free Full Text Thermal Transport Evolution Due To Nanostructural Transformations In Ga Doped Indium Tin Oxide Thin Films

Why It S Super Important To Lock Your Mortgage Rate

Mortgage Rate Locks The Complete Guide Fees Faq S More

Should You Lock In An Interest Rate On A Mortgage Loan Movement Mortgage Blog

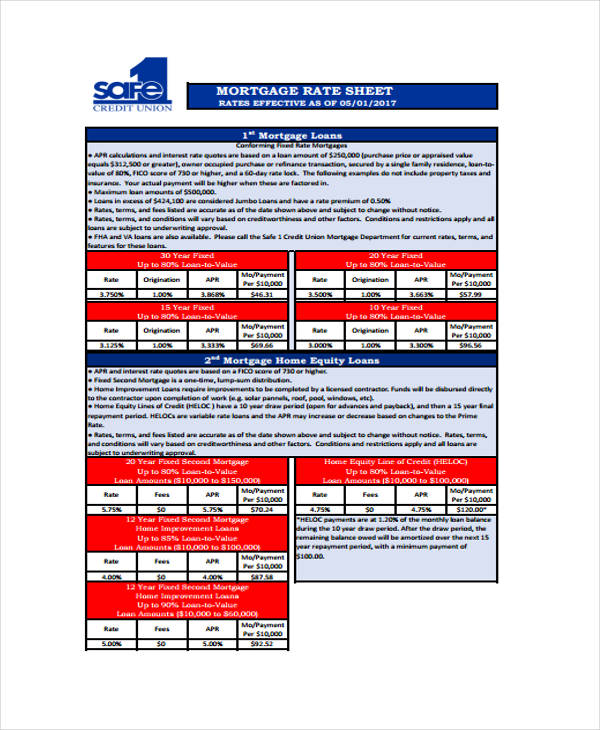

44 Sheet Examples Psd Ai Word Pdf

Mortgage Rate Lock When Do I Lock In My Interest Rate Nerdwallet